Meat Slicer Machine Price - Chinese Manufacturer, Factory, Supplier

Meat Slicer Machine Price dynamics reflect more than mere equipment costs—they embody the intersection of operational efficiency, food safety compliance, and long-term ROI in commercial kitchens. For culinary enterprises navigating capital expenditure matrices, understanding the meat slicer machine price spectrum requires analyzing three critical dimensions: structural integrity, precision engineering, and regulatory adaptability.

Entry-level manual models with 1500W motors start around **800–1,200**, suitable for artisanal charcuterie counters requiring intermittent slicing. These units often feature stamped stainless steel blades with ±0.5mm thickness tolerances, adequate for occasional prosciutto service but prone to harmonic vibrations during high-volume operations. Mid-range semi-automatic variants (2,500–4,500) introduce CNC-calibrated blades and dynamic load sensors, reducing meat wastage by 18–22% through real-time pressure compensation algorithms.

Industrial-grade solutions commanding **7,000–15,000** in meat slicer machine price tiers integrate HACCP-compliant components like self-sanitizing blade housings and NSF-certified food-grade polymers. Their brushless DC motors maintain 0.1mm slicing consistency across 12-hour cycles, critical for sushi conveyor belt operations slicing 300kg+ of tuna daily. At the apex, hyperspecialized machines (18,000–25,000) deploy cryogenic blade chilling systems and AI-driven predictive maintenance, slashing energy expenditure per kilogram by 40% through thermal inertia optimization.

Hidden variables dramatically influence true meat slicer machine price calculations. NSF/ANSI 169 compliance adds 12–15% to baseline costs but eliminates 90% of microbial cross-contamination risks. Modular quick-release mechanisms, while elevating initial investments by **1,200–2,000**, reduce sanitation labor hours by 6 weekly. Operators must also factor in blade reconditioning cycles—carbon steel edges demand $200 biannual sharpening, whereas diamond-coated variants maintain submicron edge retention for 18–24 months despite higher upfront costs.

A New York delicatessen case study reveals how optimizing meat slicer machine price selection impacts profitability. Upgrading from a 3,200unittoa9,800 model with portion-control presets reduced over-slicing waste by 31%, achieving breakeven within 14 months through saved brisket yields. The machine’s integrated load cells automatically adjusted blade angles for variable marbling densities, preserving $18/kg premium cut integrity.

Ultimately, meat slicer machine price strategies should align with throughput thermodynamics and ergonomic interfaces. A 15,000machineslicing80kg/hourat0.08kW/kgoutperformscheaperalternativesconsuming0.15kW/kgwhenelectricitycostsexceed0.28/kWh. By correlating AMP ratings with local energy tariffs, caterers unlock hidden ROI vectors that transcend sticker prices—transforming capital outlays into culinary competitive advantages.

Fish Slicer Machine

Fish Slicer Machine Heavy Duty Meat Slicer Machine

Heavy Duty Meat Slicer Machine Automatic Meat Slicer Machine

Automatic Meat Slicer Machine Electric Cooked Meat Slicer

Electric Cooked Meat Slicer Frozen Meat Slicer

Frozen Meat Slicer Honey Processing Equipment

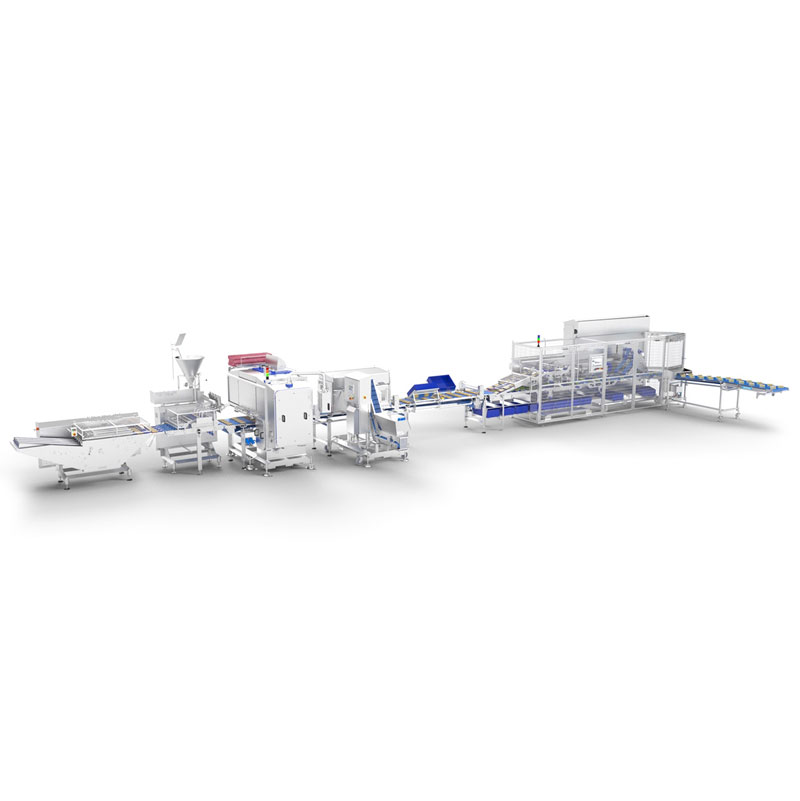

Honey Processing Equipment Sandwich Production Line

Sandwich Production Line Sauce Filling Machine

Sauce Filling Machine Tomato Juice Processing Production Line

Tomato Juice Processing Production Line Canned Beans Production Line

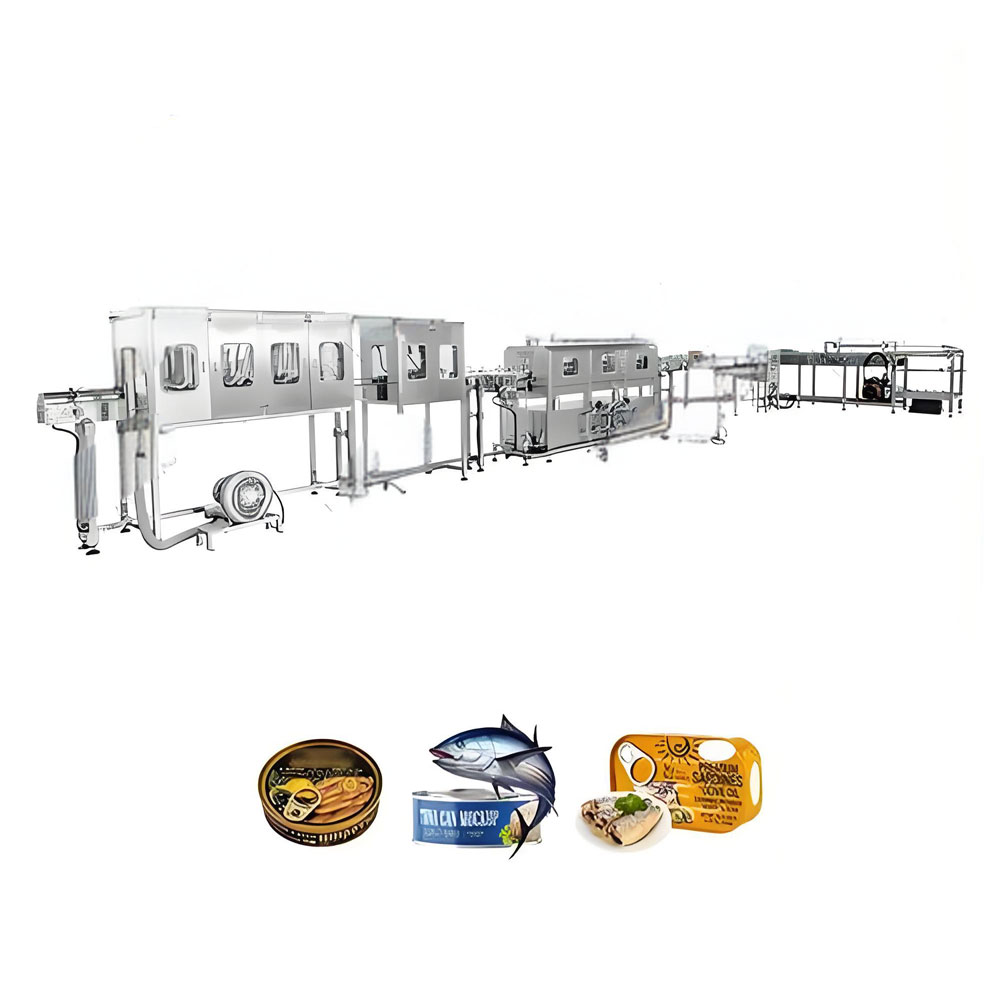

Canned Beans Production Line Canned Sardine Production Line Equipment

Canned Sardine Production Line Equipment Canned Fruit Production Line Equipment

Canned Fruit Production Line Equipment Yogurt Making Machine

Yogurt Making Machine