Food Processing Equipment: A Market Poised for Growth and Innovation

1. Introduction

Background: The food processing industry boasts a rich history, evolving from rudimentary manual processes to the highly automated and technology-intensive industry we see today. Its trajectory has consistently mirrored population growth, shifting consumer preferences, and technological advancements. From traditional grain milling and meat processing to modern freeze-drying and high-pressure processing, food processing technologies continuously innovate to meet escalating demands for food quality, safety, and convenience.

Market Importance: Food processing equipment is the cornerstone of modern food production, directly influencing output, quality, safety, and cost. Without advanced, efficient processing equipment, meeting the burgeoning global food demand and achieving sustainable food industry growth would be impossible.

2. Market Overview

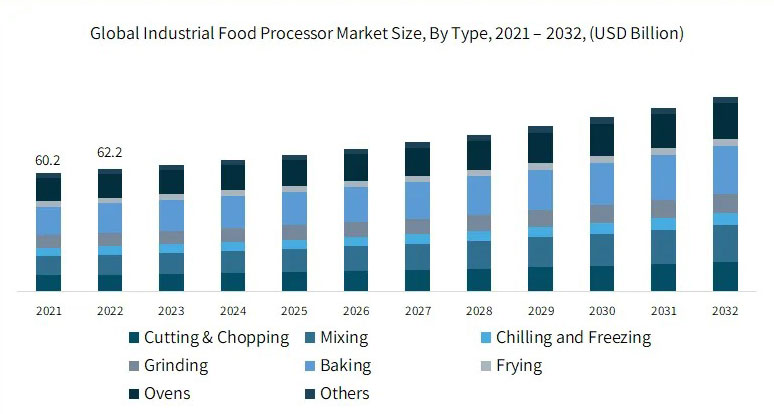

Market Size and Growth Rate: The global food processing equipment market reached $1012.2 billion in 2024. It's projected to grow at a Compound Annual Growth Rate (CAGR) of 5.71%, reaching $1336.3 billion by 2029.

Market Drivers:

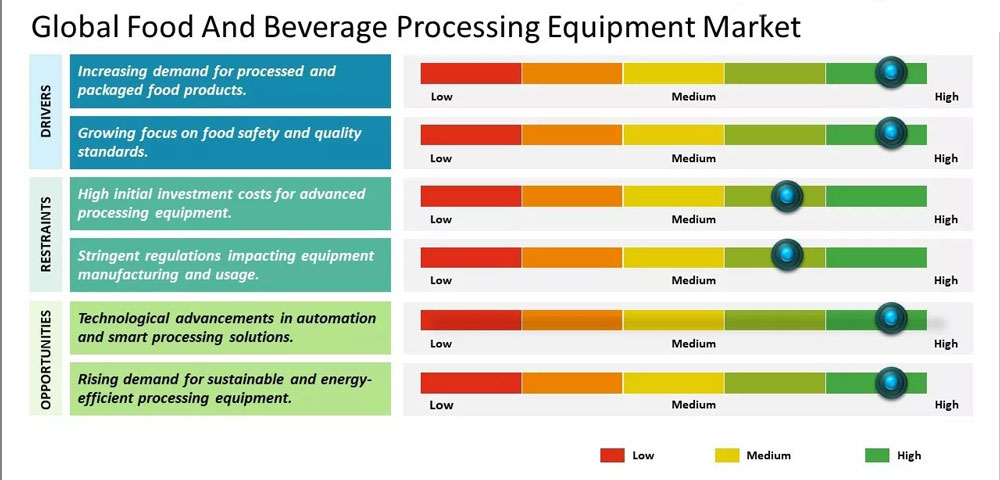

Shifting Consumer Preferences: Modern consumers increasingly favor convenient and ready-to-eat foods, driving demand for pre-packaged meals, frozen foods, and convenience foods, thereby boosting the related equipment market. Fast-paced lifestyles and busy schedules contribute to this preference for time-saving food solutions.

Technological Advancements: Automation, the Internet of Things (IoT), Artificial Intelligence (AI), and big data analytics significantly improve efficiency, precision, and safety in food processing while reducing production costs. These technology-driven innovations invigorate the food processing equipment market.

Government Policies and Incentives: Many governments implement supportive policies, including subsidies, tax breaks, and incentives for technological upgrades, to bolster the food industry. For instance, some nations encourage the adoption of energy-efficient and environmentally friendly equipment to achieve sustainable development goals.

3. In-depth Analysis of Market Drivers

Growing Demand for Processed Foods:

Increased Demand in Developing Countries: Rapid economic growth and rising living standards in developing nations fuel explosive growth in processed food demand. Processed foods offer extended shelf life, ease of storage and transportation, and cater to the needs of expanding urban populations.

Rise of the Middle Class and Changing Consumption Habits: The global rise of the middle class alters consumption patterns. Consumers increasingly demand higher food quality, safety, and diversity, stimulating advancements in food processing technology and equipment demand.

Technological Advancements:

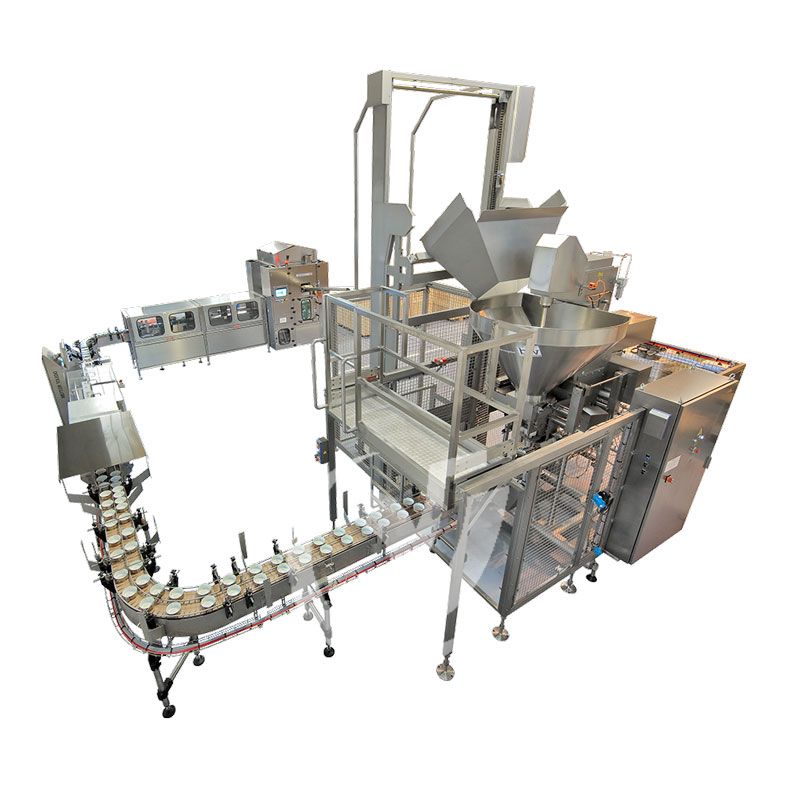

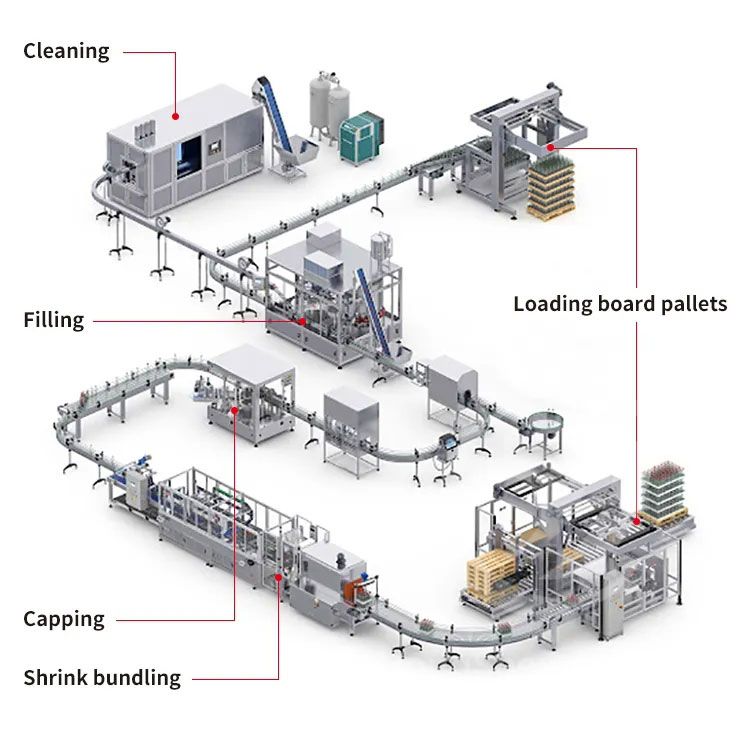

Automation in Production Processes: Automation is increasingly prevalent, encompassing automated packaging, sorting, and cleaning. This enhances efficiency, reduces labor costs, and minimizes human error.

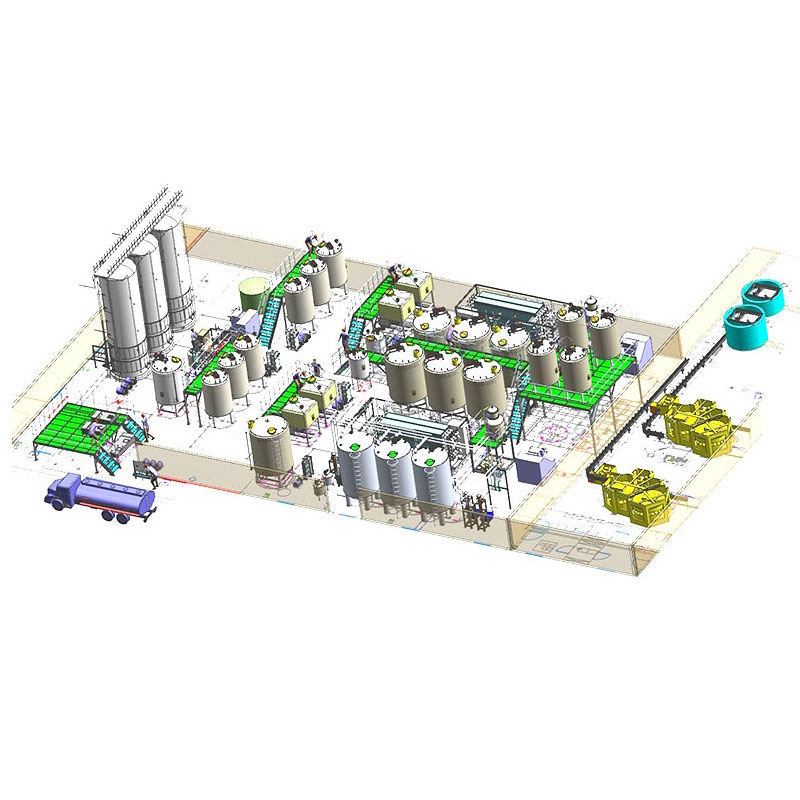

IoT and Data Analytics Integration: IoT allows real-time monitoring of process parameters, enabling data analysis to optimize production, enhance product quality, and predict potential failures.

Government Incentives:

Support Policies Across Nations: Governments tailor policies to their contexts, focusing on agricultural modernization, food safety, or green development.

Subsidies and Tax Benefits for New Equipment: Governments encourage the adoption of advanced equipment through subsidies and tax breaks to enhance productivity and competitiveness.

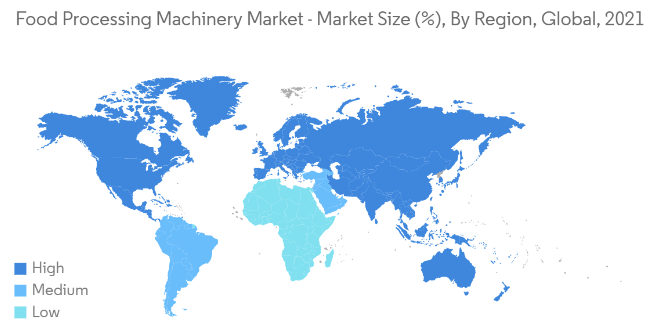

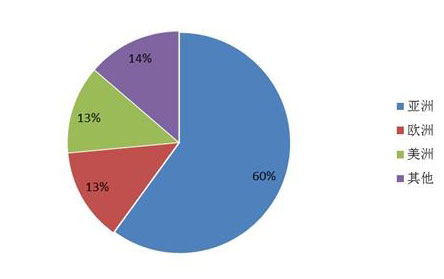

4. Regional Market Analysis

European Market: Dominated by France, Germany, and the UK, the European market emphasizes high-quality, high-performance, and highly automated equipment. Stringent food safety and quality standards drive investment in advanced processing technologies.

Asia-Pacific Region: China and India are key growth drivers. Their large populations and expanding middle classes offer significant market potential. Changing consumption habits and increasing demand for convenient foods fuel the need for automated and efficient equipment.

North American Market: The US and Canadian markets show sustained demand for packaging and processing equipment, particularly in frozen foods, convenience foods, and pre-packaged meals. Technological innovation and a focus on food safety further drive demand for advanced equipment.

Latin America and Middle East Markets: These emerging markets present significant opportunities but face challenges in infrastructure development, technological levels, and policy stability. Government policies are crucial for their future growth.

5. Market Trends

Increased Food Processing Automation: Automation spans the entire process, from raw material handling to packaging and distribution. It enhances efficiency, consistency, and food safety, minimizing human error.

Focus on Sustainability: Companies increasingly prioritize environmental sustainability, investing in energy-efficient equipment and technologies to reduce energy consumption and environmental impact. This includes low-energy refrigeration, wastewater treatment systems, and recyclable packaging.

Rise of Smart Equipment: IoT enables real-time monitoring, data collection, and analysis to optimize production, enhance quality, and predict and prevent problems. Data-driven decision-making becomes crucial for competitiveness.

6. Competitive Landscape

Major Market Players: The market includes large corporations and numerous smaller firms, including Bühler AG, Krones AG, Tetra Pak, GEA Group, and Bosch Packaging Technology. They differ in technological innovation, market share, and global reach.

Competitive Strategies: Companies leverage technological innovation, R&D investment, mergers and acquisitions, and strategic partnerships to enhance competitiveness and market share. Technological leadership is a key competitive advantage.

Market Share Analysis: Large firms generally hold significant market share, but smaller companies leverage specialization and flexibility to thrive in niche markets.

7. Recent Market Dynamics

New Product Launches: Innovative equipment emerges, including AI-powered automated sorting systems, IoT-based real-time monitoring systems, and rapid freezing equipment utilizing advanced heat treatment. These technologies better meet market demands for efficiency, quality, and safety.

Industry Collaborations and Acquisitions: Collaborations and acquisitions accelerate market consolidation and technological innovation.

8. Ongoing Challenges and Market Risks

Cost Pressures: Rising raw material prices, energy costs, and labor costs put pressure on both manufacturers and users.

Policy Risks: Changes in government policies, such as stricter environmental regulations or adjustments to trade policies, can significantly impact the market.

Technological Update Challenges: Rapid technological advancements require continuous upgrades and R&D investment to maintain competitiveness.

9. Future Outlook

Market Development Prospects: The global food processing equipment market is expected to continue growing, with automation, intelligence, and sustainability driving future development.

Corporate Response Strategies: Companies need to actively innovate, increase R&D investment, and collaborate to address market competition and technological challenges.

Future Technological Innovations: Future trends may include advanced automation, widespread AI applications in food processing, and more environmentally friendly and energy-efficient equipment.

10. Conclusion

The global food processing equipment market exhibits robust growth driven by changing consumer preferences, technological advancements, and supportive government policies. Automation, intelligence, and sustainability will shape future trends. Companies must adapt to market changes, enhance innovation and R&D, and effectively manage challenges and risks to maintain competitiveness. Staying informed about market dynamics, tracking technological advancements, and proactively addressing challenges are essential for success in this dynamic industry.

Must-Read Blogs For Chain Restaurants Owner

Aseptic Canning Production Line Equipment

Aseptic Canning Production Line Equipment Sweet Corn Canning Production Line

Sweet Corn Canning Production Line Egg Canning Production Line

Egg Canning Production Line Meat Canned Food Production Line

Meat Canned Food Production Line

Ready to Get Started?